SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(Rule 14a-101)

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantxý Filed by a

Partyparty other than the Registrant

¨Check the appropriate box:

☐

| | | | | |

| Check the appropriate box: |

¨ | ☐ | Preliminary Proxy Statement |

| ☐ | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | ý | Definitive Proxy Statement | | |

¨ | ☐ | Definitive Additional Materials | | |

¨ | ☐ | Soliciting Material Pursuant tounder §240.14a-12 |

DexCom, Inc. | | | | | | | | | | | | | | |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

DexCom, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | No fee required.required |

| ¨ | |

| ☐ | Fee paid previously with preliminary materials |

| | |

| ☐ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| | | | | | | | |

| | |

| Our Mission: Empowering People to Take Control of Health | | (1)

| Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

April 6, 2016

To Our Stockholders:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders of Corporate Overview

DexCom, Inc.

empowers people to

be held at DexCom’s offices located at 6310 Sequence Drive,take control of diabetes through innovative continuous glucose monitoring ("CGM") systems. Headquartered in San Diego, California,

92121, on May 19, 2016, at 2:00 p.m. local time.The matters expectedDexcom has emerged as a leader of diabetes care technology. By listening to be acted upon at the meeting are described in detail inneeds of users, caregivers, and providers, Dexcom simplifies and improves diabetes management around the following Notice of Annual Meeting of Stockholders and Proxy Statement.

We are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose.

Whether or not you plan to attend the annual meeting, please vote as soon as possible. As an alternative to voting in person at the annual meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting by any of these methods will ensure your representation at the annual meeting.

We look forward to seeing you at the meeting.

world. | | | | | |

|

| April 22, 2024 |

| To Our Stockholders |

| |

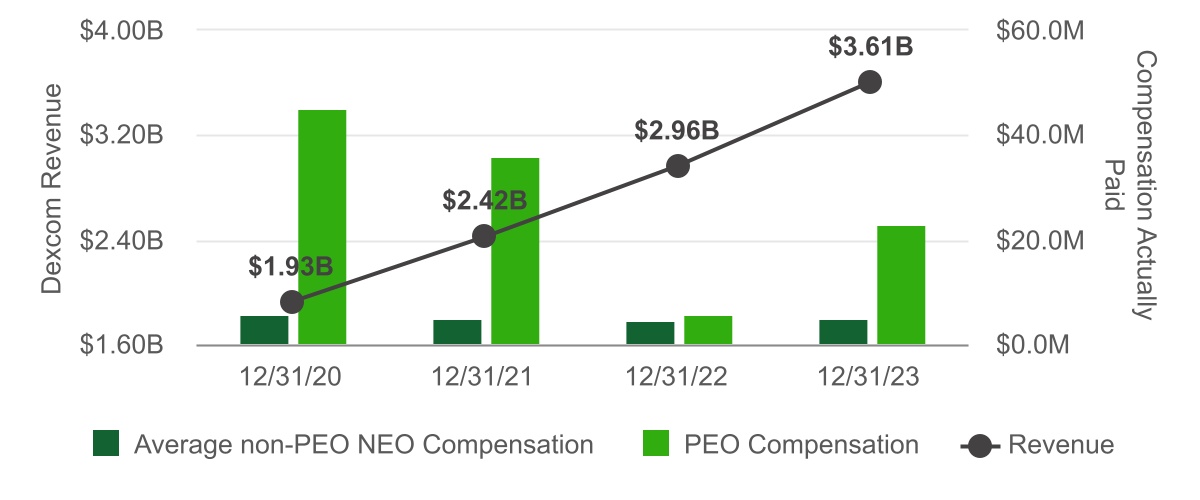

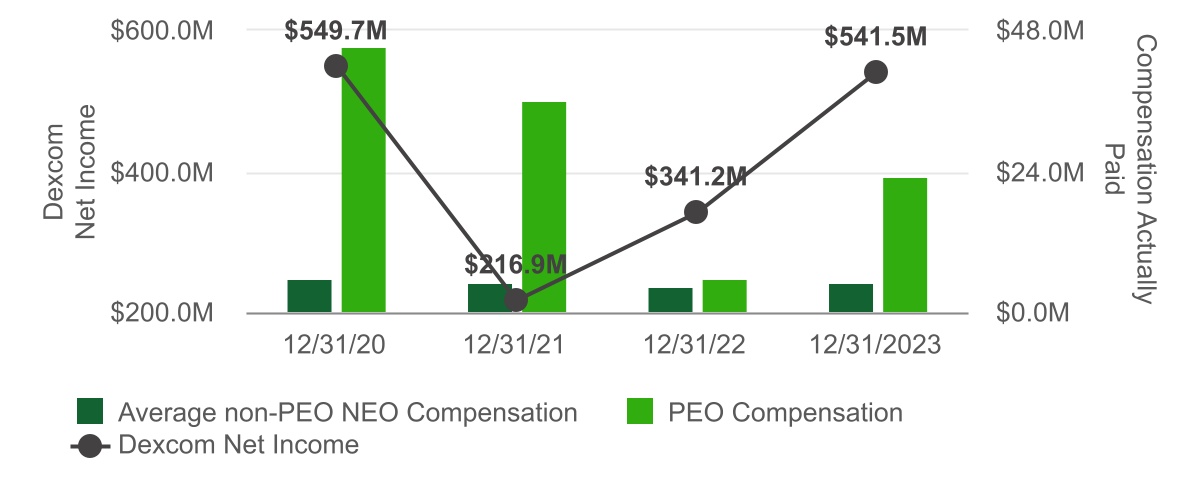

| You are cordially invited to attend the 2024 Annual Meeting of Stockholders of DexCom, Inc. online on May 22, 2024, at 2:00 p.m. Pacific Time (the "Annual Meeting"). As we approach the Annual Meeting, I would like to share with you some of our business and financial highlights from 2023, as well as some of our recent corporate sustainability initiatives. Business and Financial Highlights During 2023 we delivered another year of strong customer growth while enhancing the scale and efficiency of our operations. Demand for Dexcom CGM remained high behind the rollout of our newest generation product, Dexcom G7, and we significantly expanded access globally. Through our dedicated efforts, we also delivered significant improvements in our financial results as compared to 2022. Our financial highlights included $3.62 billion in revenue, up 24% from 2022, and $2.29 billion in gross profit, up 22% from 2022. We had $597.7 million in operating income, up 53% from 2022, and $541.5 million in net income, up 59% from 2022. We also had $748.5 million in operating cash flow, up 12% from 2022, and ended fiscal 2023 with cash, cash equivalents and short-term marketable securities totaling $2.72 billion. Our operational highlights included expanded access across our product portfolio driven by our key strategic initiatives and a growing market share globally. This past year, we increased our prescriber base by approximately 40% in the United States as Dexcom G7’s ease of use and leading performance attracted new clinicians to our ecosystem. We also completed the largest expansion of coverage in our company’s history with new reimbursement for people with type 2 diabetes using basal-insulin only, as well as for certain non-insulin using individuals that experience hypoglycemia. To support this growing demand, we initiated production at our new Malaysia manufacturing facility around mid-year 2023, which meaningfully expanded our capacity potential and further diversified our production footprint. Corporate Sustainability Initiatives In 2023, we further developed Dexcom’s approach to corporate sustainability by (i) engaging an independent expert to conduct an adjusted pay gap analysis of our workforce with respect to gender globally and race/ethnicity in the United States; and (ii) adding additional disclosure to our 2024 sustainability report concerning new emissions data and cybersecurity risk management. We also continued to provide disclosures aligned to the Sustainability Accounting Standards Board Index for the Medical Equipment and Supplies industry and the Task Force on Climate-Related Financial Disclosures in our 2024 sustainability report. We continue to work as an organization to advance our strategic corporate sustainability roadmap by pursuing key corporate sustainability workstreams.

|

| | | | | |

| |

| 2024 Annual Meeting We are pleased to provide stockholders with an opportunity to participate in the Annual Meeting online via the Internet to facilitate stockholder attendance and provide a consistent experience to all stockholders regardless of location. We will provide a live webcast of the Annual Meeting at www.proxydocs.com/DXCM, where you will also be able to submit questions and vote online. The matters expected to be acted upon at the Annual Meeting are described in detail in the following Notice of Annual Meeting of Stockholders and Proxy Statement. Your vote is very important to us. We strongly encourage you to read both our Proxy Statement and 2023 Annual Report on Form 10-K in their entirety and ask that you support our recommendations. We sincerely appreciate your continued support of Dexcom, and we look forward to seeing you at the meeting. |

| | | | | | | | |

| Sincerely, |

| | |

|

| Kevin R. Sayer |

Chairperson, President and Chief Executive Officer DexCom, Inc. April 22, 2024 |

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the annual meeting, you may submit your proxy and voting instructions via the Internet atwww.proxyvote.com or by telephone, or, if you receive a paper proxy card and voting instructions by mail, you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Please refer to the section entitled “Voting via the Internet, by Telephone or by Mail” on page 2 | | | | | | | | |

| | |

| YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting virtually via the internet, we strongly encourage you to vote your shares. In order to ensure your representation at the Annual Meeting, you may submit your proxy and voting instructions via the Internet at www.proxydocs.com/DXCM, by telephone, or you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). The Proxy Statement, the Annual Report and the accompanying proxy card are being mailed and made available to each stockholder entitled to vote at the Annual Meeting on or about April 22, 2024.

Please refer to the proxy card you received in the mail and the section of this Proxy Statement entitled “Information about the Proxy Materials and the Annual Meeting" for a description of these voting methods. If your shares are held by a bank, brokerage firm or other holder of record (your record holder), please follow the instructions you receive from such firm, bank or other nominee to vote your shares. | |

| | |

DEXCOM, INC.

6340 Sequence Drive

San Diego, California 92121

NOTICE OF

2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2016Dear Stockholder:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders of DexCom, Inc., a Delaware corporation. The meeting will be held on May 19, 2016 at 2:00 p.m. local time at our offices located at 6310 Sequence Drive, San Diego, California 92121, for the following purposes:

1. To elect three Class II directors to hold office until our 2019 Annual Meeting of Stockholders. DexCom’s Board of Directors has nominated the following persons for election as Class II directors:

Steven R. Altman

Barbara E. Kahn

Jay S. Skyler

2. To ratify the selection by the audit committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

3. To hold a non-binding vote on an advisory resolution to approve executive compensation.

4. To conduct

| | | | | |

| |

| Location | Date and Time |

| Attend the Annual Meeting Online at: | Wednesday, May 22, 2024 |

| www.proxydocs.com/DXCM | 2:00 p.m. Pacific Time |

| | | | | | | | | | | | | | | | | |

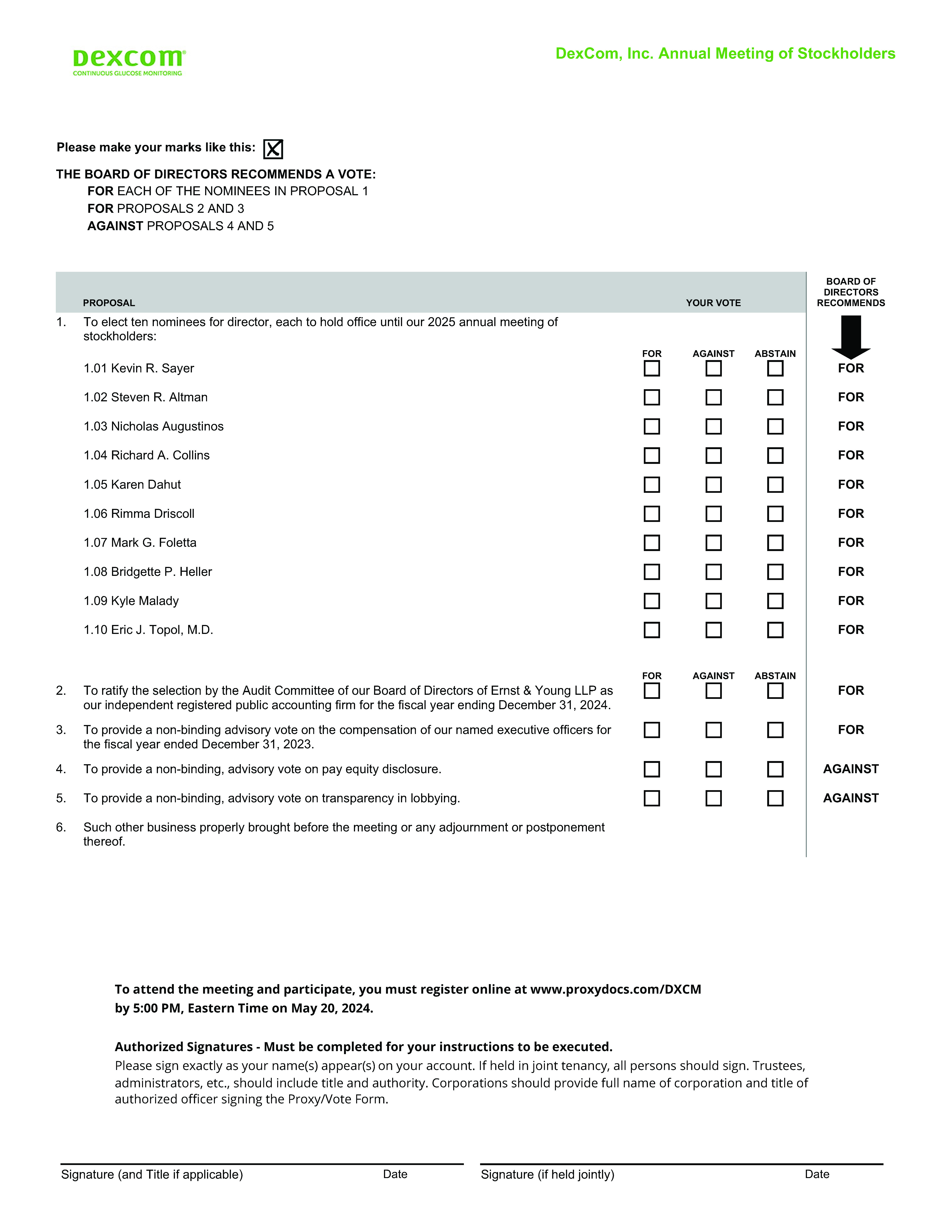

| Company Proposals | | Board Recommendation | Page |

| | | | | |

| (1) | To elect ten nominees for director, each to hold office until our 2025 annual meeting of stockholders. The nominees are: | þ | FOR each nominee | |

•Kevin R. Sayer •Steven R. Altman •Nicholas Augustinos •Richard A. Collins •Karen Dahut | •Rimma Driscoll •Mark G. Foletta •Bridgette P. Heller •Kyle Malady •Eric J. Topol, M.D. |

| | | | | |

| (2) | To ratify the selection by the Audit Committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | þ | FOR | |

| | | | | |

| (3) | To provide a non-binding advisory vote on the compensation of our named executive officers for the fiscal year ended December 31, 2023 | þ | FOR | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Stockholder Proposals | | Board Recommendation | Page |

| | | | | |

| (4) | To provide a non-binding, advisory vote on pay equity disclosure. | ☒ | AGAINST | |

| | | | | |

| (5) | To provide a non-binding, advisory vote on transparency in lobbying. | ☒ | AGAINST | |

We may also transact any other business properly brought before the

meeting.These items2024 Annual Meeting of business are more fully describedStockholders (the "Annual Meeting"). The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting in-person. The accompanying proxy materials include instructions on how to participate in the Proxy Statement accompanying this Notice.

The record date forAnnual Meeting and how you may vote your shares.

You are entitled to notice of and to vote at the annual meeting is March 30, 2016. Only stockholdersAnnual Meeting if you were a stockholder of record atas of the close of business on that date may vote at the meeting or any adjournment or postponement thereof.March 27, 2024 (the "Record Date"). A complete list of stockholders entitled to vote at the annual meetingof record will be available for inspectionthe examination of any stockholder, for any purpose germane to the meeting, for a period of 10 calendar days prior to the Annual Meeting at DexCom’sour principal executive offices, located at 6340 Sequence Drive, San Diego, California, 92121 between the address listed above.Whether or nothours of 9:00 a.m. and 4:00 p.m. Pacific Time. If you planare interested in viewing the list, please contact Investor Relations by email at investor-relations@dexcom.com. The list will also be open to attend the annual meeting, please vote as soon as possible. As an alternativeexamination of any stockholder during the Annual Meeting.

| | | | | | | | | | | |

| Voting Methods |

| | | |

| Internet | Telephone | Mail |

| | | |

| For detailed information regarding voting instructions, please refer to the proxy card you received in the mail and the section of this Proxy Statement entitled "Information about the Proxy Materials and the Annual Meeting”. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. If you decide to virtually attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting online at the Annual Meeting. |

| | | |

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to voting in person atbe Held on May 22, 2024

The Proxy Statement, the annual meeting, you may vote viaAnnual Report and the Internet, by telephone or, if you receive a paperform of proxy card inare available at www.proxydocs.com/DXCM after entering the mail, by mailing a completed proxy card. For detailed information regarding voting instructions, please refer to the section entitled “Voting via the Internet, by Telephone or by Mail”control number printed on page 2 of the Proxy Statement. You may revoke a previously delivered proxy at any time prior to the annual meeting. If you decide to attend the annual meeting and wish to change your proxy vote, you may do so automatically by voting in person at the annual meeting.card. | | |

| By Order of the Board of Directors, |

|

|

|

| Kevin R. Sayer |

Kevin Sayer |

| Chairperson, President and Chief Executive Officer |

| April 22, 2024 |

San Diego, California

April 6, 2016

DEXCOM, INC.

6340 Sequence Drive

San Diego, California 92121

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 19, 2016

INFORMATION ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Our Board recommends a vote "FOR" the following ten nominees for election to our Board, each to hold office until our 2025 annual meeting of stockholders: | |

| | | | | | | | | | | | | | | |

| | 1) | | Kevin R. Sayer | 2) | | Steven R. Altman | 3) | | Nicholas Augustinos | | 4) | | Richard A. Collins | |

| | | | | | | | | | | | | | | |

| | 5) | | Karen Dahut | 6) | | Rimma Driscoll | 7) | | Mark G. Foletta | | 8) | | Bridgette P. Heller | |

| | | | | | | | | | | | | | | |

| | 9) | | Kyle Malady | 10) | | Eric J. Topol, M.D. | | | | | | | | |

| | | | | | | | | | | | | | | |

| þ | | | | | | | | | | | | | |

| | THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES NAMED ABOVE. | |

| | | | | | | | | | | | | |

At each annual meeting of stockholders, the terms of each of our incumbent directors expire and all members of our Board are elected. Ten directors are to be elected at this Annual Meeting, each to serve until our 2025 annual meeting of stockholders or until such director’s earlier death, resignation or removal. On the Nominating and Governance Committee’s recommendation, the Board has nominated each of the above listed nominees for election at the Annual Meeting. Each of the nominees is a current director of the company. Each nominee has consented to being named in this Proxy

MaterialsThe accompanying proxy is deliveredStatement and solicited on behalfhas agreed to continue to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve. For more information concerning the nominees, see the section entitled “Nominee Director Biographies”.

As of the date of mailing of this Proxy Statement, the Board consists of eleven members. Barbara E. Kahn, who has served as a director of the company since 2011, was not nominated for re-election to the Board and her term as a director will expire at the Annual Meeting. Effective upon the Annual Meeting, the Board has approved a reduction in the size of the Board of from eleven to ten directors.

Directors

of DexCom, Inc., a Delaware corporation, in connection with the 2016 Annual Meeting of Stockholders, which is being held at 2:00 p.m. local time on May 19, 2016 at our offices located at 6310 Sequence Drive, San Diego, California 92121. The Notice of Internet Availability of Proxy Materials (“Notice”) and proxy statement and form of proxy are

being distributed and made available on the Internet on or about April 6, 2016. As a stockholder, you are invited to attend the annual meeting and are requested to vote on the items of business described in this proxy statement. The proxy materials include our proxy statement for the annual meeting, an annual report to stockholders, including our Annual Report on Form 10-K for the year ended December 31, 2015, and the proxy card or a voting instruction card for the annual meeting.Voting Rights

Only stockholders of record of DexCom, Inc. (“DexCom” or the “Company”) common stock on March 30, 2016, the record date, will be entitled to vote at the annual meeting. Each holder of record will be entitled to one vote on each matter for each share of common stock held on the record date. On the record date, there were 83,395,601 shares of common stock outstanding.

The holders of a majority of the outstanding shares of common stock entitled to vote at the annual meeting must be present or represented by proxy at the annual meeting in order to have a quorum. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the annual meeting. A broker non-vote occurs when a bank, broker or other holder of record holding shares for a beneficial owner submits a proxy for the annual meeting but does not vote on a particular proposal, except for Proposal No. 2, because that holder does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. If the persons present or represented by proxy at the annual meeting constitute the holders of less than a majority of the outstanding shares of common stock entitled to vote at the annual meeting, the annual meeting may be adjourned by the chairperson of the annual meeting to a subsequent date for the purpose of obtaining a quorum.

In an election of directors, our Bylaws and our Corporate Governance Principles require that directors must be elected by a majority of the votes cast in uncontested elections. This meanselections, meaning that the number of votes cast “For” a director nominee must exceed the number of votes cast “Against” that nominee. Abstentions and if applicable, broker non-votes are not counted as votes “For” or “Against” a director nominee and have no effect on the outcome of the proposal for the election of directors. Each current director and any director nominee must, promptly following such person’s election or re-election, submitPursuant to Dexcom’s Corporate Governance Principles (“Governance Principles”), the Board an irrevocableof Directors expects a director to tender his or her resignation effective upon such person’s failureif he or she fails to receive the required vote at the next annual meeting at which they face re-election. Following an uncontested election in which any nominee who does not receive a majority of votes cast “For” his or her election, the Board is required to decide whether to accept such resignation, and it will disclose its decision-making process. In contested elections, the required vote would be a plurality of votes cast. Full details of this policy are set forth in our Corporate Governance Principles, which is available athttp://investor.shareholder.com/dexcom/governance.cfm.

The other proposals require the approval of a majority of shares present and entitled to vote on the matter either in person or by proxy. Abstentions and broker non-votes will not be counted for any purpose in determining whether these proposals have been approved.

On each matter to be voted upon, stockholders of record have one vote for each share of common stock owned by them as of the close of business on March 30, 2016, the record date for the annual meeting. Stockholders may not cumulate votes in the election of directors.

Admission to Meeting

You are entitled to attend the annual meeting if you were a stockholder of record or a beneficial owner of our common stock as of March 30, 2016, the record date, or you hold a valid legal proxy for the annual meeting. If you are a stockholder of record, you may be asked to present valid picture identification, such as a driver’s license or passport, for admission to the annual meeting.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

Recommendations of the Board of Directors

DexCom’s Board of Directors recommends that you vote:

FOR each of the nominees of the Board of Directors (Proposal No. 1);

FOR the ratification of the appointment of Ernst & Young LLP as DexCom’s independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal No. 2); and

FOR the non-binding advisory resolution to approve executive compensation (Proposal No. 3).

Voting via the Internet, by Telephone or by Mail

Holders of shares of DexCom common stock whose shares are registered in their own name with DexCom’s transfer agent, American Stock Transfer & Trust Company, are record holders. As an alternative to voting in person at the annual meeting, record holders may vote via the Internet, by telephone or, for those stockholders who receive a paper proxy card in the mail, by mailing a completed proxy card.

For those record holders who receive a paper proxy card, instructions for voting via the Internet, telephone or by mail are set forth on the proxy card. If you are a stockholder who elects to vote by mail, you should sign and mail the proxy card in the addressed, postage paid envelope that was enclosed with the proxy materials, and your shares will be voted at the annual meeting in the manner you direct. In the event that you return a signed proxy card on which no directions are specified, your shares will be votedFOReach of the nominees of the Board of Directors (Proposal No. 1),FOR the ratification of the appointment of Ernst & Young LLP as DexCom’s independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal No. 2) andFOR the non-binding advisory resolution to approve executive compensation (Proposal No. 3), and in the discretion of the proxy holders as to any other matters that may properly come before the annual meeting or any postponement or adjournment of the annual meeting.

DexCom stockholders whose shares are not registered in their own name with American Stock Transfer & Trust, are beneficial holders of shares held in street name. Such shares may be held in an account at a bank or at a

brokerage firm (your record holder). As the beneficial holder, you have the right to direct your record holder on how to vote your shares, and you will receive instructions from your record holder that must be followed in order for your record holder to vote your shares per your instructions. Many banks and brokerage firms have a process for their beneficial holders to provide instructions via the Internet or by telephone. If Internet or telephone voting is unavailable from your record holder, simply complete and mail the voting instruction card provided to you by your record holder to ensure that your vote is counted. If your shares are held beneficially in street name and you have not given your record holder voting instructions, your record holder will not be able to vote your shares with respect to any matter other than ratification of the appointment of DexCom’s independent registered public accounting firm. Shares held beneficially in street name may be voted by you in person at the annual meeting only if you obtain a legal proxy from your record holder giving you the right to vote such shares in person at the annual meeting.

For those stockholders who receive a Notice (described under “Internet Availability of Proxy Materials” below), the Notice provides information on how to access your proxy on the Internet, which contains instructions on how to vote via the Internet or by telephone. If you received a Notice, you can request a printed copy of your proxy materials by following the instructions contained in the Notice.

Revocation of Proxies

You may revoke or change a previously delivered proxy at any time before the annual meeting by delivering another proxy with a later date, by voting again via the Internet or by telephone, or by delivering written notice of revocation of your proxy to DexCom’s Secretary at DexCom’s principal executive offices before the beginning of the annual meeting. You may also revoke your proxy by attending the annual meeting and voting in person, although attendance at the annual meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares through a bank or brokerage firm, you must contact that bank or brokerage firm to revoke any prior voting instructions. You also may revoke any prior voting instructions by voting in person at the annual meeting if you obtain a legal proxy as described under “Admission to Meeting” above.

Results of Annual Meeting

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a current report on Form 8-K no later than four business days after the date the annual meeting ends.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report, and voting via the Internet. The Notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly, and helps conserve natural resources.

PROPOSAL 1

ELECTION OF DIRECTORS

As of the date of mailing of this Proxy Statement, our Board of Directors (the “Board of Directors” or “Board”) consists of nine members and is divided into three classes, each of which has a three-year term. Class I currently consists of Terrance H. Gregg, Kevin Sayer and Nicholas Augustinos, Class II currently consists of Steven R. Altman, Barbara E. Kahn and Jay S. Skyler, and Class III currently consists of Mark Foletta, Jonathan T. Lord and Eric J. Topol. Three Class II directors are to be elected at this annual meeting to serve until our 2019 Annual Meeting of Stockholders and until their successors are duly elected and qualified, or until their death, resignation or removal. The terms of the directors in Classes III and I expire at our 2017 and 2018 Annual Meetings of Stockholders, respectively.

The nominees for Class II directors are Steven R. Altman, Barbara E. Kahn and Jay S. Skyler, each of whom is a current director. Mr. Altman has served on the Board since November 2013, Dr. Kahn has served since April 2011 and Dr. Skyler has served since September 2002. Each of Mr. Altman and Drs. Kahn and Skyler has agreed to continue to serve as directors if elected, and we have no reason to believe that the nominees will be unable to serve.

Directors are elected by a majority of votes cast in an uncontested election. A majority of the votes cast means that the number of votes cast “For” a directorfor re-election. If any nominee must exceed the number of votes cast “Against” that nominee. In contested elections (an election in which the number of nominees for election as director is greater than the number of directors to be elected) the vote standard would be a plurality of the votes cast.

In accordance with our Corporate Governance Principles (available on our website athttp://investor.shareholder.com/dexcom/governance.cfm), the Board will nominate for election only candidates who agree, if elected, to tender, promptly following such person’s election or re-election, an irrevocable resignation that will be effective upon (i) such person’s failure to receive the required vote at the next annual meeting at which they face re-election, and (ii) the Board’s acceptance of such resignation, at which point, any unvested portion of annual equity grants to a director whose resignation becomes effective shall become fully vested. In addition, the Board will fill director vacancies and new directorships only with candidates who agree to tender the same form of resignation promptly following their appointment to the Board. Each of Mr. Altman and Drs. Kahn and Skyler has provided an irrevocable resignation.

If an incumbent director fails to receive the required votevotes for election, then,re-election at the Annual Meeting, the Nominating and Governance Committee will determine on an expedited basis, and in any event within 90 days following certification of the stockholder vote, whether to accept or reject the resignation, and will submit such recommendation for prompt consideration by the Board. The Board will promptly act on the Nominating and Governance Committee’s recommendation and will publicly disclose its decision-making process and decision regarding whether to accept the director’s resignation offer (or the reason(s) for rejectingor reject the resignation offer (including, if applicable) in a Form 8-K furnished to the SEC. Any director who tenders his or her resignation pursuant to this provision of our Corporate Governance Principles may not participate in the Board action regarding whether to acceptit rejects the resignation offer.

Recommendation ofoffer, the Board

THErationale behind its decision).

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR “FOR” THE ELECTION OF EACH DIRECTOR NOMINEE. PROXIES RECEIVED BY THE NOMINEES NAMED ABOVE.COMPANY WILL BE VOTED FOR EACH DIRECTOR NOMINEE UNLESS OTHERWISE INSTRUCTED.

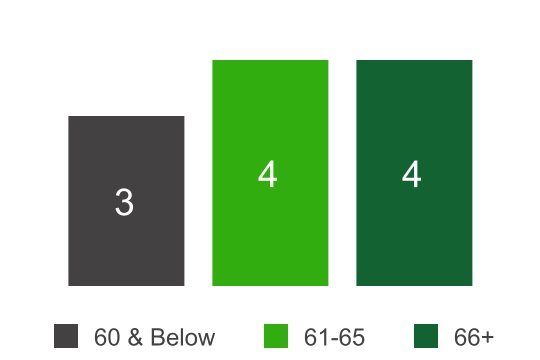

The following table shows the composition of our Board, including each director's position, age, and duration of service as of the Record Date.

| | | | | | | | | | | | | | | | | | | | |

| Director Name | | Position(s) | | Age | | Director Since |

| Director Nominees: | | | | | | |

| Kevin R. Sayer | | Chairperson of the Board, President and CEO | | 66 | | 2007 |

| Steven R. Altman | | Director | | 62 | | 2013 |

| Nicholas Augustinos | | Director | | 65 | | 2009 |

| Richard A. Collins | | Director | | 67 | | 2017 |

| Karen Dahut | | Director | | 60 | | 2020 |

| Rimma Driscoll | | Director | | 51 | | 2023 |

| Mark G. Foletta | | Lead Independent Director | | 63 | | 2014 |

| Bridgette P. Heller | | Director | | 62 | | 2019 |

| Kyle Malady | | Director | | 57 | | 2020 |

| Eric J. Topol, M.D. | | Director | | 69 | | 2009 |

| Non-Continuing Director: | | | | | | |

| Barbara E. Kahn | | Director | | 71 | | 2011 |

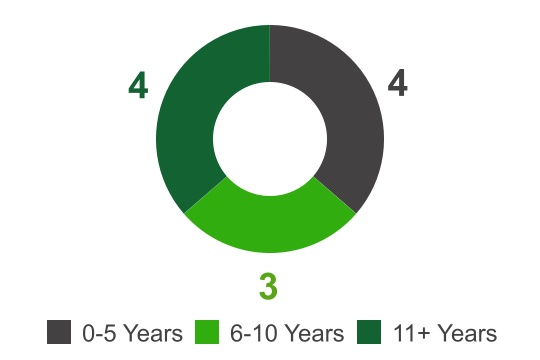

We believe our Board nominees bring a variety of backgrounds, qualifications, skills and experiences that contribute to a well-rounded Board uniquely positioned to effectively guide our strategy and oversee our operations. The following sets forth the biographical information of our Board as of March 27, 2024. Please note that one of our current directors, Barbara E. Kahn, has not been renominated for election and will no longer serve on the Board following the date of the Annual Meeting.

| | | | | | | | | | | | | | |

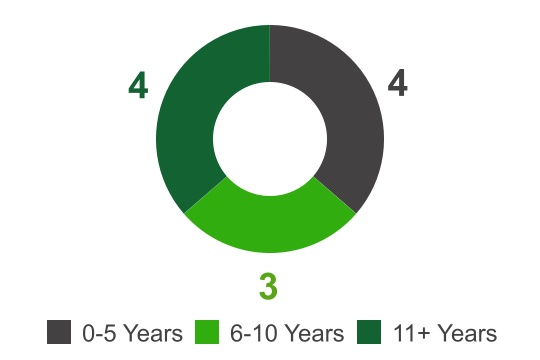

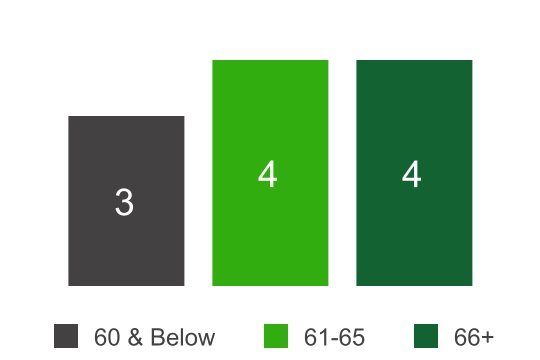

| Highly Independent | | Balanced Tenure | | New Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

10 of 11 |

All independent,

except the CEO |

| | | | | | | | |

| 4 |

|

|

|

|

|

|

| | |

| New directors hired in the last five years |

| | | | | | | | | | | | | | |

| Board Engagement | | Age Distribution | | Gender Diversity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 100% | |

| |

| |

| |

| |

| |

| | | | | | | | | |

| Attendance rate for each director for the four board meetings held in 2023 |

Due to the global and complex nature of our business, the Board believes it is biographicalimportant to consider diversity of professional experiences, race, ethnicity, gender, sexual orientation, age, education, and cultural background in evaluating board candidates in order to provide practical insights and diverse perspectives. Representation of gender, race, ethnic, geographic, cultural, or other diverse perspectives expands the Board’s understanding of the needs and viewpoints of our customers, partners, employees, governments, and other stakeholders worldwide. As part of our ongoing commitment to creating a balanced Board with diverse viewpoints and deep industry expertise, we periodically add new directors to infuse new ideas and fresh perspectives in the boardroom.

The Board Diversity Matrix (Table A below) presents our Board diversity information as of March 30, 201627, 2024. Each of the categories listed in the table below has the meaning set forth in The Nasdaq Stock Market LLC (“Nasdaq”) Listing Standards Rule 5605(f).

| | | | | | | | |

| Table A |

| | |

| Board Diversity Matrix as of March 27, 2024 |

| | |

| | |

| Total Number of Directors | 11 |

| | |

| Part I: Gender Identity | Female | Male |

| Directors | 4 | 7 |

| Part II: Demographic Background | | |

| African American or Black | 1 | — |

| | |

| | |

| | |

| | |

| White | 3 | 7 |

| | |

| LGBTQ+ | 1 |

| |

Table B below presents diversity information for the nominees for Class II directors and each person whose termdirector nominees.

| | | | | | | | |

| Table B |

| | |

| Nominee and Continuing Director Demographics |

| | |

| | |

| Total Number of Directors | 10 |

| | |

| Part I: Gender Identity | Female | Male |

| Directors | 3 | 7 |

| Part II: Demographic Background | | |

| African American or Black | 1 | — |

| | |

| | |

| | |

| | |

| White | 2 | 7 |

| | |

| LGBTQ+ | 1 |

| |

| | | | | | | | | | | | | | |

Name

| | Age | | | Position

|

Class I Directors | | | | | | |

Terrance H. Gregg

| | | 67 | | | Executive Chairman of the Board of Directors |

Kevin Sayer

| | | 58 | | | President, Chief Executive Officer (“CEO”) andNominee Director |

Nicholas Augustinos

| | | 57 | | | Director |

Class II Directors | | | | | | |

Steven R. Altman | | | 54 | | | Director |

Barbara E. Kahn

| | | 63 | | | Director |

Jay S. Skyler, M.D.

| | | 69 | | | Director |

Class III Directors | | | | | | |

Mark Foletta | | | 55 | | | Lead Independent Director |

Jonathan T. Lord, M.D.

| | | 61 | | | Director |

Eric Topol, M.D.

| | | 61 | | | Director Biographies |

Nominees for Election for a Three-year Term Expiring at the 2019 Annual Meeting

Steven

| | | | | | | | | | | | | | |

| Kevin R. Sayer |

| Chairperson of the Board, President and CEO | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 66 | 2007 | None | | None |

| | | | |

Kevin R. Altmanhas served on our Board since November 2013. From November 2011 through January 2014, Mr. Altman served as the vice chairman of Qualcomm Incorporated (“Qualcomm”) and a member of Qualcomm’s executive committee. Mr. Altman previously served as the president of Qualcomm from July 2005 to November 2011, as Executive Vice President from November 1997 to June 2005 and as President of Qualcomm Technology Licensing from September 1995 to April 2005. Mr. Altman was the chief architect of Qualcomm’s strategy for licensing its broad intellectual property portfolio for wireless communications, which has accelerated the growth of CDMA technology. Mr. Altman served on the board of Ubiquiti Networks, Inc., a publicly traded company that develops networking technology for service providers and enterprises, from October 2013 to December 2015. Mr. Altman received a B.S. from Northern Arizona University in Police Science and Administration and a J.D. from the University of San Diego. Mr. Altman brings to the Board significant senior leadership, and technical and global experience. Mr. Altman’s experiences with Qualcomm allow him to provide DexCom with valuable insights on corporate strategy and initiatives that are critical to the continued growth and maturation of DexCom.Barbara E. Kahnhas served on our Board since April 2011. Since January 2011, Dr. Kahn has served as the Patty and Jay H. Baker Professor of Marketing and the Director of the Jay H. Baker Retailing Center at The Wharton School, where she previously served as the Dorothy Silberberg Professor of Marketing from June 1990 to July 2007. Prior to rejoining Wharton, Dr. Kahn served for three and a half years as the Dean and Schein Family Chair Professor of Marketing at the School of Business Administration, University of Miami, Coral Gables, Florida from August 2007 to January 2011. Dr. Kahn received her Ph.D., M.B.A. and M.Phil degrees from Columbia University, and a B.A. in English Literature from the University of Rochester. Through Dr. Kahn’s experience in consumer-based research, she provides the Board with senior leadership and important guidance on issues relating to market and product development.

Jay S. Skyler, M.D., MACPhas served on our Board since September 2002. Dr. Skyler is a Professor of Medicine, Pediatrics and Psychology and Deputy Director of the Diabetes Research Institute at the University of Miami in Florida, where he has been employed since 1976. For 22 years, Dr. Skyler also served as Study Chairman for the National Institute of Diabetes & Digestive & Kidney Diseases Type 1 Diabetes clinical trials network. He is a past President of the American Diabetes Association and a past Vice-President of the International Diabetes Federation. Dr. Skyler served as a director of Amylin Pharmaceuticals, Inc. until its acquisition by Bristol-Myers Squibb Company in August 2012, and served as a director of MiniMed, Inc. until its acquisition by Medtronic, Inc. in 2001. Dr. Skyler received a B.S. from Pennsylvania State University and an M.D. from Jefferson Medical College. As a scholar and educator in the field of endocrinology, Dr. Skyler brings

to the Board industry and technical experience directly related to DexCom’s research and development activities. In addition, Dr. Skyler’s board service with other public companies provides cross-board experience.

Directors Continuing in Office Until the 2017 Annual Meeting

Mark Foletta has served on our Board since November 2014 and has served as our Lead Independent Director since November 2015. Mr. Foletta previously served as Senior Vice President, Finance and Chief Financial Officer of Amylin Pharmaceuticals, Inc., a public pharmaceutical company, from March 2006 through Amylin’s acquisition by Bristol Myers-Squibb Company in August 2012, and as Vice President, Finance and Chief Financial Officer of Amylin from 2000 to 2006. Prior to joining Amylin in 2000, Mr. Foletta held a number of management positions with Intermark, Inc. and Triton Group Ltd. from 1986 to 2000 and served as an Audit Manager with Ernst & Young. Mr. Foletta is currently a member of the Board of Directors and Audit Committee of AMN Healthcare Services, Inc., a publicly traded healthcare workforce solutions provider, and Regulus Therapeutics, Inc., a publicly traded biopharmaceutical company. Since August 2015, Mr. Foletta has served as the interim CFO of Biocept, Inc., an early commercial-stage publicly traded molecular oncology diagnostics company. Mr. Foletta is also on the Board of Directors of Viacyte, Inc., a private biotechnology company. Mr. Foletta received a B.A. in Business Economics from the University of California, Santa Barbara and is a member of the Corporate Directors Forum. Mr. Foletta’s considerable audit and financial experience in the biotechnology and pharmaceutical sectors qualifies him to serve on the Board.

Jonathan T. Lord, M.D.has served on our Board since May 2008, and served as our Chairman from May 2010 until December 31, 2014 when, on January 1, 2015, Mr. Gregg became Chairman after resigning as DexCom’s Chief Executive Officer and served as our Lead Independent Director from January 2015 until November 2015. Recently Dr. Lord served as a professor of pathology at the University of Miami’s Miller School of Medicine after serving as the Chief Operating Officer of the Miller School and UHealth-University of Miami Health System from March 2012 to January 31, 2013. From August 2011 to March 2012, Dr. Lord served as the Chief Innovation Officer at the University of Miami, Florida. From April 2009 to January 2010, Dr. Lord served as President and Chief Executive Officer of Navigenics, Inc., a privately held healthcare company. From April 2000 to April 2009, Dr. Lord served as Chief Innovation Officer and Senior Vice President at Humana Inc., a health benefits company. From October 1999 to April 2000, Dr. Lord served as President of Health Dialog, a health information provider, and from April 1997 to October 1999, he served as Chief Operating Officer of the American Hospital Association, a national organization representing hospitals, health care networks and their patients. Dr. Lord also serves as a director of Biolase, Digital Reasoning, Par 80, and Velano Vascular. Dr. Lord also serves in an advisory board role for ViaGenetics. From 2012 to 2015, Dr. Lord served in an advisory board role for Third Rock Ventures. Dr. Lord received a B.S. degree in chemistry and a M.D. degree from the University of Miami. Through Dr. Lord’s experience in healthcare technology and insurance, he provides the Board with senior leadership and critical guidance on issues relating to technology, market and commercial development.

Eric Topol, M.D. has served on our Board since July 2009. Since January 2007, Dr. Topol has served as the Director of the Scripps Translational Science Institute, a National Institutes of Health funded program of the Clinical and Translational Science Award Consortium. He is Professor of Genomics at the Scripps Research Institute, the Chief Academic Officer of Scripps Health, and a senior consulting cardiologist at Scripps Clinic. Prior to Scripps, Dr. Topol served on the faculty of Case Western Reserve University as a professor in genetics, chaired the Department of Cardiovascular Medicine at Cleveland Clinic for 15 years and founded the Cleveland Clinic Lerner College of Medicine. Dr. Topol serves as a digital medical advisor to Google, AT&T, Walgreens, Quanttus, and Sotera Wireless. In April 2009, he co-founded the West Wireless Health Institute. As a practicing physician, academic and thought leader in wireless healthcare technologies, Dr. Topol is uniquely situated to provide the Board with guidance on its technology, clinical and market development.

Directors Continuing in Office until the 2018 Annual Meeting

Terrance H. Gregghas served on our Board since May 2005 and served as our Chief Executive Officer from June 2007 until January 2015. Mr. Gregg concurrently served as our President from June 2007 to June

2011. Effective January 1, 2015, Mr. Gregg assumed a new role with DexCom as Executive Chairman of the Board of Directors. In this role, Mr. Gregg is employed as an executive officer and will continue to lead our external efforts. From 1999 to June 2007, Mr. Gregg served as a director of Vasogen, Inc., an immunotherapy company focused on heart failure and neurogenerative diseases, and served as its Chairman from 2006 to 2007. Since 2004, Mr. Gregg served as a Special Venture Partner with Galen Collaborative Capital, a private equity firm. Since 2015, Mr. Gregg also has served on Sectoral Asset Management’s New Emerging Medical Opportunities Advisory Board, a private equity fund focused on companies involved with the development of new pharmaceuticals, medical technology and related products to serve the global healthcare market. Mr. Gregg has also operated Soleil Partners LLC, formerly THG Consulting LLC, a healthcare advisory firm since 2002. From July 2002 to September 2004, Mr. Gregg served as a senior advisor to the diabetes business of Medtronic, Inc., a medical technology company. Mr. Gregg served as President and Chief Operating Officer of MiniMed, Inc., a medical technology company focused on insulin pumps for people with diabetes, from October 1996 until its acquisition by Medtronic, Inc. in August 2001, and Mr. Gregg served as a Vice President of Medtronic and President of Medtronic MiniMed after the acquisition until July 2002. Mr. Gregg formerly served as the Chairman of the American Diabetes Association Research Foundation Board. Mr. Gregg received a B.S. from Colorado State University. As our Executive Chairman, Mr. Gregg brings to the Board significant senior leadership, industry, technical, and global experience.

Kevin Sayer

has served on our Board since November 2007, as our President and Chief Executive Officer (“CEO”) since January 2015 and as our Chairperson of the Board (“Chairperson”) since July 2018. Mr. Sayer has been our President since June 2011. From2011, and from January 2013 until January 2015, Mr. Sayer also served as our Chief Operating Officer. In connection with Mr. Gregg assuming a new role as Executive Chairman of the Board of Directors, Mr. Sayer assumed the role of Chief Executive Officer effective on January 1, 2015. From April 2007 to December 2010, Mr. Sayer served as Chief Financial Officer of Biosensors International Group, Ltd. (“Biosensors”), a medical technology company developing, manufacturing and commercializing medical devices used in interventional cardiology and critical care procedures. Prior to joining Biosensors, from May 2005 to April 2007, Mr. Sayer served as an independent healthcare and medical technology industry consultant. From March 2004 to May 2005, Mr. Sayer was Executive Vice President and Chief Financial Officer of Specialty Laboratories, Inc., a company offering clinical reference laboratory services. From August 2002 to March 2004, Mr. Sayer worked as an independent healthcare and medical technology industry consultant. Mr. Sayer served as Chief Financial Officer of MiniMed, Inc. from May 1994 until it was acquired by Medtronic, Inc. in August 2001. Mr. Sayer served as Vice President and General Manager of Medtronic MiniMed after the acquisition until August 2002. Mr. Sayer is a Certified Public Accountant (inactive) and received his Master’sMaster's Degree in Accounting and Information Systems concurrently with a B.A., both from Brigham Young University. As CEO, Mr. Sayer has direct responsibility for our strategy and operations.

| | | | | | | | | | | | | | |

| Steven R. Altman |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 62 | 2013 | Compensation, Nominating and Governance | | None |

| | | | |

Steven R. Altman has served on our Board since November 2013. From January 2021 to December 2023, Mr. Altman served as the Chairman of the Board of Directors of Prospector Capital Corporation, a publicly-traded blank check company, prior to the completion of a business combination between Prospector Capital and LeddarTech Holdings Inc. in December 2023. From November 2011 through January 2014, Mr. Altman served as the Vice Chairman of Qualcomm Incorporated (“Qualcomm”) and a member of Qualcomm’s Executive Committee. Mr. Altman previously served as President of Qualcomm from July 2005 to November 2011, as Executive Vice President from November 1997 to June 2005 and as President of Qualcomm Technology Licensing from September 1995 to April 2005. Mr. Altman was the chief architect of Qualcomm’s strategy for licensing its broad intellectual property portfolio for wireless communications, which has accelerated the growth of CDMA technology. Mr. Altman received a B.S. from Northern Arizona University in Political Science and Administration and a J.D. from the University of San Diego. Mr. Altman brings to the Board significant senior leadership, and technical and global experience. Mr. Altman’s experiences with Qualcomm allow him to provide Dexcom with valuable insights on corporate strategy and initiatives that are critical to the continued growth and maturation of Dexcom.

| | | | | | | | | | | | | | |

| Nicholas Augustinos |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 65 | 2009 | Nominating and Governance | | None |

| | | | |

Nicholas (Nick) Augustinoshas served on our Board since November 2009. SinceFrom December 2015 through December 2018, Mr. Augustinos has served as President and CEO of Aver, Inc., dba Enlace Health, a company specializing in bundled paymentValue-Based Reimbursement, Analytics and analytics solutions andPayment Solutions. He has served on the Board of Directors of Aver since September 2014.2014, and was Chairman of the Board of Directors of Aver during 2019. From November 2011 until

December 2015, Mr. Augustinos worked forwas with Cardinal Health, Inc. (NYSE: CAH) as its Senior Vice President for Health Information Services and Strategy. From March 2005 through October 2011, Mr. Augustinos worked forat Cisco Systems, Inc. (“Cisco”)(NASDAQ: CSCO), athe global leader in networking company.and cloud solutions. At Cisco, he held various positions, including Director of Cisco’s Internet Business Solutions Group, Senior Director, Global Healthcare Solutions Group, and most recently Senior Director of Global Healthcare Operations. In January 2015, Mr. Augustinos was appointed to the Board of Directors of the California Health Care Foundation (“CHCF”), an endowed foundation which seeks to improve care for all Californians through innovations that improve quality, increase efficiency, and lower the cost of care. He serves at the Finance & Investment Committee and the Governance Committee which he chaired for three years.Prior to CHCF, he served on the Board of Directors of the SCAN Foundation, an organizationendowed foundation dedicated to advancing the development of a sustainable continuum of quality care for seniors, from June 2011 until December 2014. Mr. Augustinos served on the Board of Directors of Audax Health, now Rally, from March 2012 until February 2014. Rally was acquired by UnitedHealthcare. In 1992 Mr. Augustinos joined Deloitte Consulting where he was instrumental establishing the healthcare practice for Northern California. In 1998 Mr. Augustinos joined Healtheon/WebMd (NASDAQ: HLTH), a newly founded healthcare information technology company leading the Customer Experience team. With a 29-year38-year career in healthcare and healthcare technology, Mr. Augustinos has broad managerial, consulting and business development experience in the private and public sectors. Mr. Augustinos has worked with a diverse range of leading healthcare delivery systems, healthcare insurers and government organizations globally and brings to the Board significant business and market development and technology experience with growth companies.

| | | | | | | | | | | | | | |

| Richard A. Collins |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 67 | 2017 | Audit, Nominating and Governance | | None |

| | | | |

Richard A. Collins has served on our Board since March 2017. Mr. Collins has been a self-employed consultant since October 2013. From March 2011 to October 2013 Mr. Collins was the Chief Executive Officer for UnitedHealthcare’s Northeast Region and was President, Director, and/or Chairman of numerous UnitedHealthcare subsidiaries including Oxford Health Plans, Mid Atlantic Medical Services and UHC Insurance Company of New York. From July 2005 through December of 2012 Mr. Collins served as the President – Individual Line of Business for UnitedHealthcare and the Chairman and Chief Executive Officer of Golden Rule Financial Corporation. Prior to 2011, Mr. Collins also held leadership positions in pricing, underwriting and healthcare economics with UnitedHealthcare. Mr. Collins has previously served on the Boards of Fairbanks Hospital in Indianapolis, Indiana, The Nature Conservancy – Indiana, United Healthcare Children’s Foundation and the Council for Affordable Health Insurance. Mr. Collins received a B.S. from Maine Maritime Academy and completed the executive development program at Harvard University’s John F. Kennedy School of Government. Mr. Collins was formerly a National Association of Corporate Directors (NACD) Board Leadership Fellow. The NACD Fellowship is a comprehensive and continuous program of study that empowers directors with the latest insights, intelligence, and leading boardroom practices. Mr. Collins' significant experience in healthcare insurance and administration, including his tenure during a period in which UnitedHealth Group grew from a mid-cap health insurer into one of the largest public corporations in America, qualify him to serve on the Board.

| | | | | | | | | | | | | | |

| Karen Dahut |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 60 | 2020 | Compensation, Technology | | None |

| | | | |

Karen Dahut has served on our Board since August 2020. In October 2022, Ms. Dahut was selected as the CEO of Google Public Sector, responsible for helping public sector clients digitally transform with the Google suite of products. Prior to this role, Ms. Dahut was the Sector President for Booz Allen's Global Defense business. Ms. Dahut held several leadership positions throughout the organization, including Chief Innovation Officer; Leader, Analytics and Data Science Business; and Leader, Economic and Business Analytics Capability. Before joining Booz Allen in 2002, Ms. Dahut served as comptroller for the Navy’s premier biomedical research institute and as a United States Naval Officer. Ms. Dahut also actively serves on the Board of Directors for the National Air and Space Museum and the Center for New American Security. Additionally, Ms. Dahut has served as a Director of EisnerAmper LLP since August 2021. She previously served on the Board of Directors of Tech Data Corporation, an end-to-end technology distributor and Fortune 100 company, prior to its acquisition by Apollo Global Management in June 2020. Ms. Dahut received a Bachelor’s degree in Finance from Mount Saint Mary’s University and a Master's of Science degree from the University of Southern California’s Viterbi School of Engineering. Ms. Dahut’s considerable leadership experience qualifies her to serve on the Board.

| | | | | | | | | | | | | | |

| Rimma Driscoll |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 51 | 2023 | Audit, Technology | | Zoetis Inc. |

| | | | |

Rimma Driscoll has served on our Board since August 2023. Ms. Driscoll currently serves as Executive Vice President and Head of Global Strategy, Commercial and Business Development, and Global BioDevices of Zoetis, the world’s leading animal health company and a member of the Fortune 500. In this role, Ms. Driscoll oversees the company’s global business strategy, the execution of commercial launch plans, external business development (M&A) and integration efforts, and has oversight for Zoetis’ Global BioDevices business. She joined Zoetis in 2016 and previously held the titles of Senior Vice President, Business Development from January 2020 to November 2022; and Vice President, Business Development and Commercial Alliances from 2016 to January 2020. Prior to joining Zoetis, Ms. Driscoll spent 21 years at Procter & Gamble where she led global business development and strategic alliances across multiple businesses in pharmaceuticals, consumer healthcare, beauty care, and new business ventures. Ms. Driscoll is a board member of Pumpkin Insurance, a preventive care and pet insurance company. Ms. Driscoll completed her Master of Business Administration from Xavier University, Williams College of Business, and her Bachelor of Science in Chemistry from Bowling Green State University. Ms. Driscoll is qualified to serve on our Board of Directors because of her significant experience leading business development initiatives and corporate strategy.

| | | | | | | | | | | | | | |

| Mark G. Foletta |

| Lead Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 63 | 2014 | Audit | | AMN Healthcare Services, Inc., & Enanta Pharmaceuticals, Inc. |

| | | | |

Mark G. Foletta has served on our Board since November 2014 and has served as our Lead Independent Director since November 2015. From February 2017 to June 2020, Mr. Foletta was the Chief Financial Officer and Executive Vice President of Tocagen, Inc., a publicly traded biotech company. From August 2015 to July 2016, Mr. Foletta served as the interim CFO of Biocept, Inc., an early commercial-stage publicly traded molecular oncology diagnostics company. Mr. Foletta previously served as Senior Vice President, Finance and Chief Financial Officer of Amylin Pharmaceuticals, Inc., a publicly traded pharmaceutical company, from March 2006 through Amylin’s

acquisition by Bristol Myers-Squibb Company in August 2012, and as Vice President, Finance and Chief Financial Officer of Amylin from 2000 to 2006. Prior to joining Amylin in 2000, Mr. Foletta held a number of management positions with Intermark, Inc. and Triton Group Ltd. from 1986 to 2000 and served as an Audit Manager with Ernst & Young. Mr. Foletta is currently a member of the Board of Directors and

its CommitteesUnder NASDAQ listing standards,Audit Committee of AMN Healthcare Services, Inc., a majoritypublicly traded healthcare workforce solutions provider. He also is a member of the members of a listed company’s Board of Directors must qualifyand Audit Committee of Enanta Pharmaceuticals, Inc. since July 2020. Mr. Foletta received a B.A. in Business Economics from the University of California, Santa Barbara and is a member of the Corporate Directors Forum. Mr. Foletta’s considerable audit and financial experience in the biotechnology and pharmaceutical sectors qualifies him to serve on the Board.

| | | | | | | | | | | | | | |

| Bridgette P. Heller |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 62 | 2019 | Compensation | | Aramark Corporation, Integral Ad Science, & Novartis AG |

| | | | |

Bridgette P. Hellerhas served on our Board since September 2019. Ms. Heller is currently leading a small nonprofit, the Shirley Proctor Puller Foundation, committed to generating better educational outcomes for underserved children in St. Petersburg, Florida. Previously, Ms. Heller served as “independent,”the Executive Vice President and President of Nutricia, the Specialized Nutrition Division of Danone from July 2016 to August 2019. From 2010 to 2015, she served as affirmatively determined byExecutive Vice President of Merck & Co., Inc. and President of Merck Consumer Care. Prior to joining Merck, Ms. Heller was President of Johnson & Johnson’s Global Baby Business Unit from 2007 to 2010 and President of its Global Baby, Kids, and Wound Care business from 2005 to 2007. She also worked for Kraft Foods from 1985 to 2002, ultimately serving as Executive Vice President and General Manager for the board. OurNorth American Coffee Portfolio. Ms. Heller serves on the Board of Directors consults with our counsel to ensure thatof Novartis, a global pharmaceuticals manufacturer and Fortune 200 company. She also serves on the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in applicable NASDAQ listing standards, as in effect from time to time.Consistent with these considerations, after review of all relevant transactions and relationships between each director, or any of his or her family members, and us, our senior management and our independent registered public accounting firm, our Board of Directors of Newman’s Own, a privately held social business and food manufacturer. Since February 2021, Ms. Heller has affirmatively determined that allserved on the Board of Directors of Aramark Corporation, a U.S. publicly traded food service and facilities provider and on the Board of Directors for Integral Ad Science, a U.S. publicly traded global media measurement and optimization company. Ms. Heller received her Bachelor’s degree in Economics and Computer Studies from Northwestern University and an MBA from Northwestern University’s Kellogg Graduate School of Management, where she is also a member of the school’s Advisory Board. Ms. Heller brings to our directors are independent directorsBoard considerable experience in business, specifically as it relates to technology and manufacturing, and she is a strong addition to the Board as Dexcom continues to expand and scale its operations.

| | | | | | | | | | | | | | |

| Kyle Malady |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 57 | 2020 | Nominating and Governance, Technology | | Verizon Communications, Inc. |

| | | | |

Kyle Maladyhas served on our Board since October 2020. Currently, Mr. Malady serves as EVP and CEO of the Verizon Business Group, a unit of Verizon Communications Inc., a telecommunications company. Previously Mr. Malady served as Executive Vice President of Global Networks and Technology and Chief Technology Officer at Verizon since August 2018. Prior to assuming this role, Mr. Malady was head of the Core Engineering and Operations organization within the meaningGlobal Network and Technology organization at Verizon from May 2012 to July 2018. He has also served as Verizon’s Vice President of New Product Development from June 2005 to April 2012. Mr. Malady is currently on the board of the applicable NASDAQ listing standards, except forCTIA, the wireless industry's trade association. Mr. Gregg,Malady also serves on the President's National Security Telecommunications Advisory Council (NSTAC). Mr. Malady received a B.S. in Mechanical Engineering from the University of Bridgeport and an MBA in Finance from the NYU Stern School of Business. Mr. Malady’s experience in numerous fields at Verizon provides him with insights and guidance that qualify him to serve on the Board.

| | | | | | | | | | | | | | |

| Eric J. Topol, M.D. |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 69 | 2009 | Technology | | None |

| | | | |

Eric J. Topol, M.D.has served on our Executive ChairmanBoard since July 2009. Since January 2007, Dr. Topol has served as the Director of the BoardScripps Translational Science Institute, a National Institutes of Health funded program of the Clinical and our former ChiefTranslational Science Award Consortium. He is Executive Officer, and Mr. Sayer, ourVice President and Chief Executive Officer. In making its independence determinations,Professor of Molecular Medicine at the Board reviewed transactionsScripps Research Institute, and relationships witha senior consulting cardiologist at Scripps Clinic. Prior to Scripps, Dr. Topol served on the director, or any memberfaculty of his or her immediate family, us or oneCase Western Reserve University as a professor in genetics, chaired the Department of our subsidiaries or affiliates,Cardiovascular Medicine at Cleveland Clinic for 15 years and our independent registered public accounting firm based on information provided byfounded the director, our records and publicly available information. Specifically, the Board considered the following typesCleveland Clinic Lerner College of relationships and transactions: (i) principal employment of and other public company directorships held by each non-employee director; (ii) contracts or arrangements that are ongoing or which existed during any of the past three fiscal years between us and/or our subsidiaries or affiliates and any entity for which the non-employee director, or his or her immediate family member, is an executive officer or greater-than-10% stockholder; and (iii) contracts or arrangements that are ongoing or which existed during any of the past three fiscal years between us and/or our subsidiaries or affiliates and any other public company for which the non-employee directorMedicine. Dr. Topol serves as a director.digital medical advisor to Blue Cross Blue Shield Association. In April 2009, he co-founded the West Wireless Health Institute, a non-profit foundation for applied medical research and policy on the prevention of aging. As required under applicable NASDAQ listing standards, our independent directors meeta practicing physician, academic and thought leader in regularly scheduled executive sessions at which only independent directors are present. Allwireless healthcare technologies, Dr. Topol is uniquely situated to provide the Board with guidance on its technology, clinical and market development.

| | | | | | | | | | | | | | |

| Corporate Governance Highlights |

Our commitment to good corporate governance practices and accountability to stockholders is described below:

| | |

|

| What We Do and Have Done |

|

•Amended our certificate of incorporation to declassify our Board of Directors •Implemented a proxy access bylaw provision •Enable our stockholders to amend our bylaws by majority vote •Apply a majority voting standard in uncontested director elections •All directors are independent except for our CEO •Enhance Board independence through regular meetings of independent directors and committees without the presence of management •Equip our Lead Independent Director with broad authority and responsibility •All members of our standing Board committees – the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and Technology Committee – are independent •Annual Board of Directors, standing committee, and individual director self-evaluations •Stockholders may recommend director nominees to the Nominating and Governance Committee •Established Board oversight of our corporate sustainability practices through our Nominating and Governance Committee •Charters of each committee of the Board clearly establish the committees’ respective roles and responsibilities •Maintain a compliance helpline available to all employees •Our Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting control or auditing matters •Adopted a Code of Conduct and Business Ethics (the "Code of Conduct") that applies to all of our directors, officers and employees worldwide •Our internal audit function maintains critical oversight over the key areas of our business and financial processes and controls, and reports directly to our Audit Committee •We have adopted stock ownership guidelines for our non-employee directors and executive officers |

|

|

| What We Don't Do |

|

•No pledging or hedging of Company securities •No multi-voting or non-voting stock |

|

| | | | | | | | | | | | | | |

| Board Leadership Structure and the Role of the Lead Independent Director |

Our Board selects its Chairperson based on what our Board

of Directors are comprised entirely of directors determined by the Board to be independent within the meaning of applicable NASDAQ listing standards and as required by SEC rules and regulations.Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board of Directors shall be free to choose its chairman in any way that it considersbelieves is in the best interests of our company and that the nominatingour stockholders. The Nominating and governance committee shallGovernance Committee periodically considerconsiders the leadership structure of our Board of Directors and make suchmakes recommendations related thereto to the Board of Directors with respect thereto assame to the nominating and governance committee deems appropriate.Board. Our Corporate Governance Principles ("Governance Principles") also provide that, whenif the positions of chairman and chief executive officer are held byChairperson is also the same person,CEO or if the independent directors shallChairperson is a former employee, the Board will designate a “lead independent director.” In cases in which the chairman and chief executive officer are the same person, the chairman schedules and sets the agenda for meetings of the Board of Directors, and the chairman, or if the chairman is not present, the lead independent director, chairs such meetings. The responsibilities of the chairman or, if the chairman and the chief executive officer are the same person, the lead independent director include: presiding at executive sessions; serving as a liaison between the chairman and the independent directors and being available, under appropriate circumstances, for consultation and direct communication with stockholders.

| | | | | | | | | | | | | | |

| | | | |

| Lead Independent Director | | Chairperson |

| | | | |

•Presides over executive sessions of independent directors; •Serves as a liaison between the Chairperson and the independent directors and communicates to the Chairperson and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by the independent directors in executive sessions or outside of meetings of the Board; •Coordinates with the Chairperson to set the agenda for meetings of the Board, taking into account input from other independent directors; •Provides leadership to the Board if circumstances arise in which the role of the Chairperson may be, or may be perceived to be, in conflict; •Available, under appropriate circumstances, for consultation and direct communication with stockholders; and •Encourages direct dialogue between all directors (particularly those with dissenting views) and management. | | | •Schedules and sets the agenda for meetings of the Board, in coordination with the lead independent director; •Presides over meetings of the full Board; •Contributes to Board governance and Board processes; •Communicates with all directors on key issues and concerns outside of Board meetings; and •Presides over meetings of stockholders. | |

| | | | |

Our Board

of Directors believes that our stockholders and

DexComDexcom currently are best served by having Kevin

R. Sayer, our CEO,

also serve as

a member of the board, Terry Gregg, our former CEO and executive chairman, serve as Executive ChairmanChairperson of the Board, and Mark

G. Foletta serve as lead independent director. Our Board

of Directors believes that the current

boardBoard leadership structure, coupled with a strong emphasis on

boardBoard independence, provides effective independent oversight of management while allowing the

boardBoard and

management to benefit from Mr. Sayer’s and Mr. Gregg’s extensive executive leadership and operational experience, including familiarity with our business. In addition, separation of the office of Chairman allows Mr. Sayer to focus on his duties as Chief Executive Officer. Our independent directors bring experience, oversight and expertise from outside of our company, while our Chairperson and CEO brings company and Executive Chairman bring company-specificindustry specific experience and expertise.

Our Board

of Directors believes that this governance structure provides strong leadership, creates clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders. Our Board

of Directors believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of the Board

of Directors and sound corporate governance policies and practices.

Board of Directors’ Role in Risk Oversight

Management continually monitors the material risks we face, including financial risk, strategic risk, operational risk and legal and compliance risk. The Board of Directors is responsible for exercising oversight of management’s identification and management of, and planning for, those risks. In fulfilling this oversight role, our Board of Directors focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. Our Board of Directors performs these functions in

Under Nasdaq listing standards, a

number of ways, including the following:at its regularly scheduled meetings, the Board of Directors receives management updates on our business operations, financial results, committee activities, and strategy and discusses risks related to the business;

the audit committee assists the Board of Directors in its oversight of risk management by discussing with management our guidelines and policies regarding financial and enterprise risk management, including major risk exposures, and the steps management has taken to monitor and mitigate such exposures;

the nominating and governance committee assists the Board of Directors in its oversight of DexCom’s legal compliance policies, including its Insider Trading Policy, compliance risk exposures and the steps management has taken to monitor or mitigate such exposures;

the compensation committee assists the Board of Directors by evaluating potential risks related to our compensation programs;

through management updates and committee reports, the Board monitors our risk management activities, including the enterprise risk management process, risks relating to our compensation programs, and financial and operational risks; and

a substantial portion of our compensation paid to employees is time-based equity that is oriented to performance as its value derives from our stock price.

Information Regarding the Board of Directors and its Committees

Our Board of Directors has an audit committee, a compensation committee and a nominating and governance committee. The following is membership and meeting information for each of these committees during the fiscal year ended December 31, 2015, as well as a description of each committee and its functions.

| | | | | | | | | | | | |

Name | | Audit

Committee | | | Compensation

Committee | | | Nominating

and Governance

Committee | |

Terrance H. Gregg | | | | | | | | | | | | |

Kevin Sayer | | | | | | | | | | | | |

Steven R. Altman | | | | | | | X | | | | X | |

Nicholas Augustinos | | | X | | | | | | | | X | |

Mark Foletta | | | X | * | | | X | | | | | |

Barbara E. Kahn | | | X | | | | | | | | | |

Jonathan T. Lord, M.D. | | | X | | | | X | | | | | |